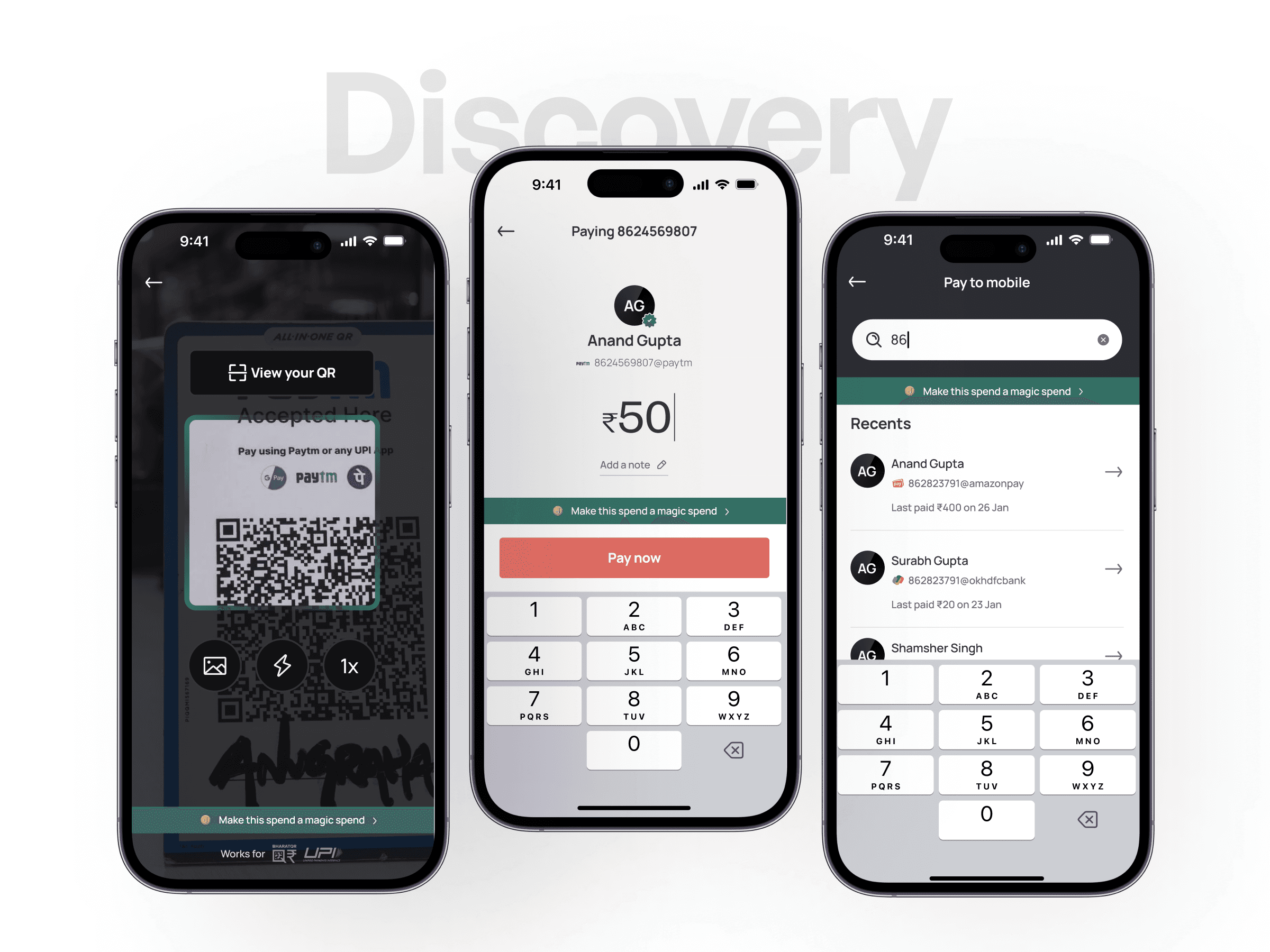

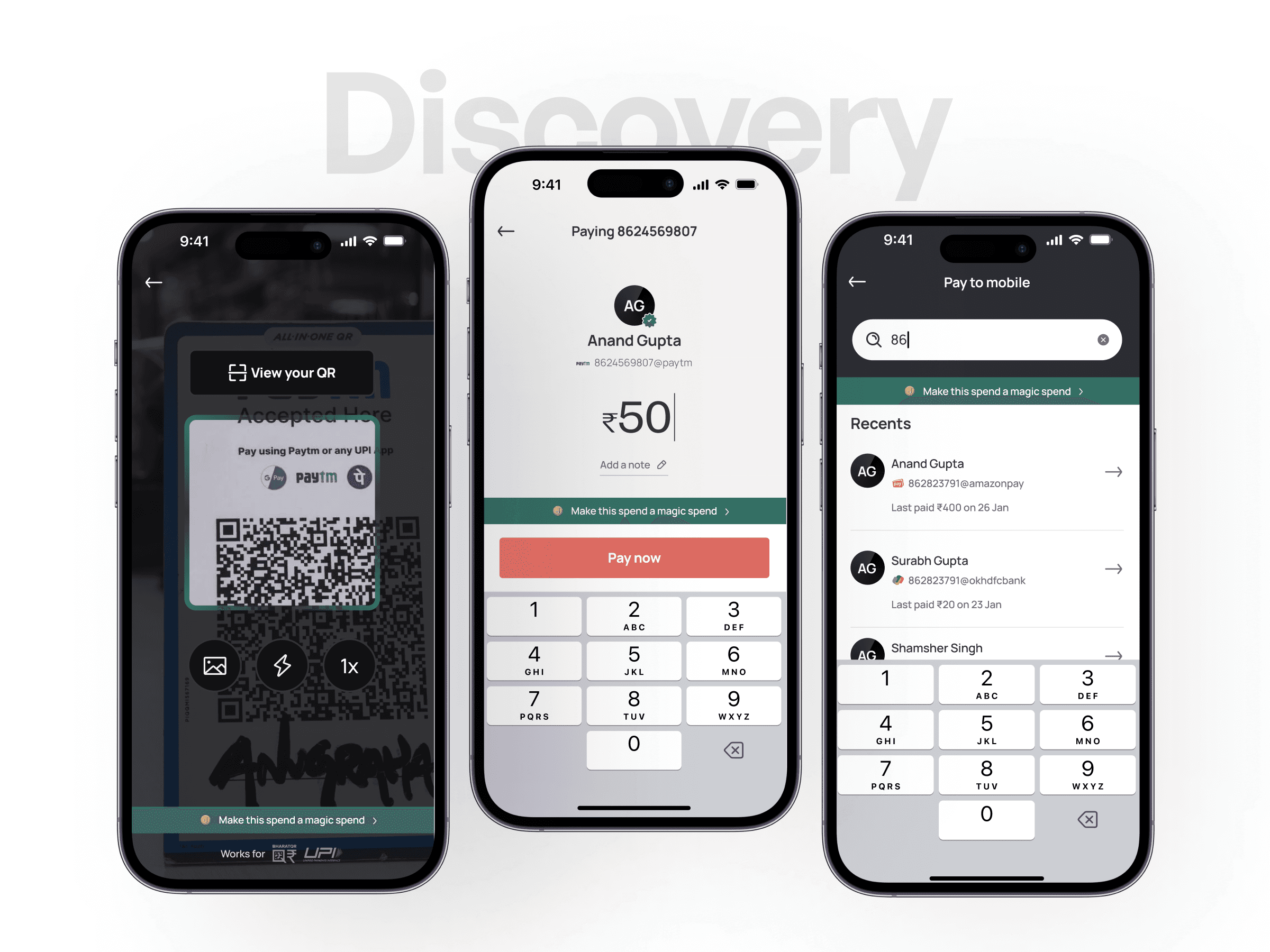

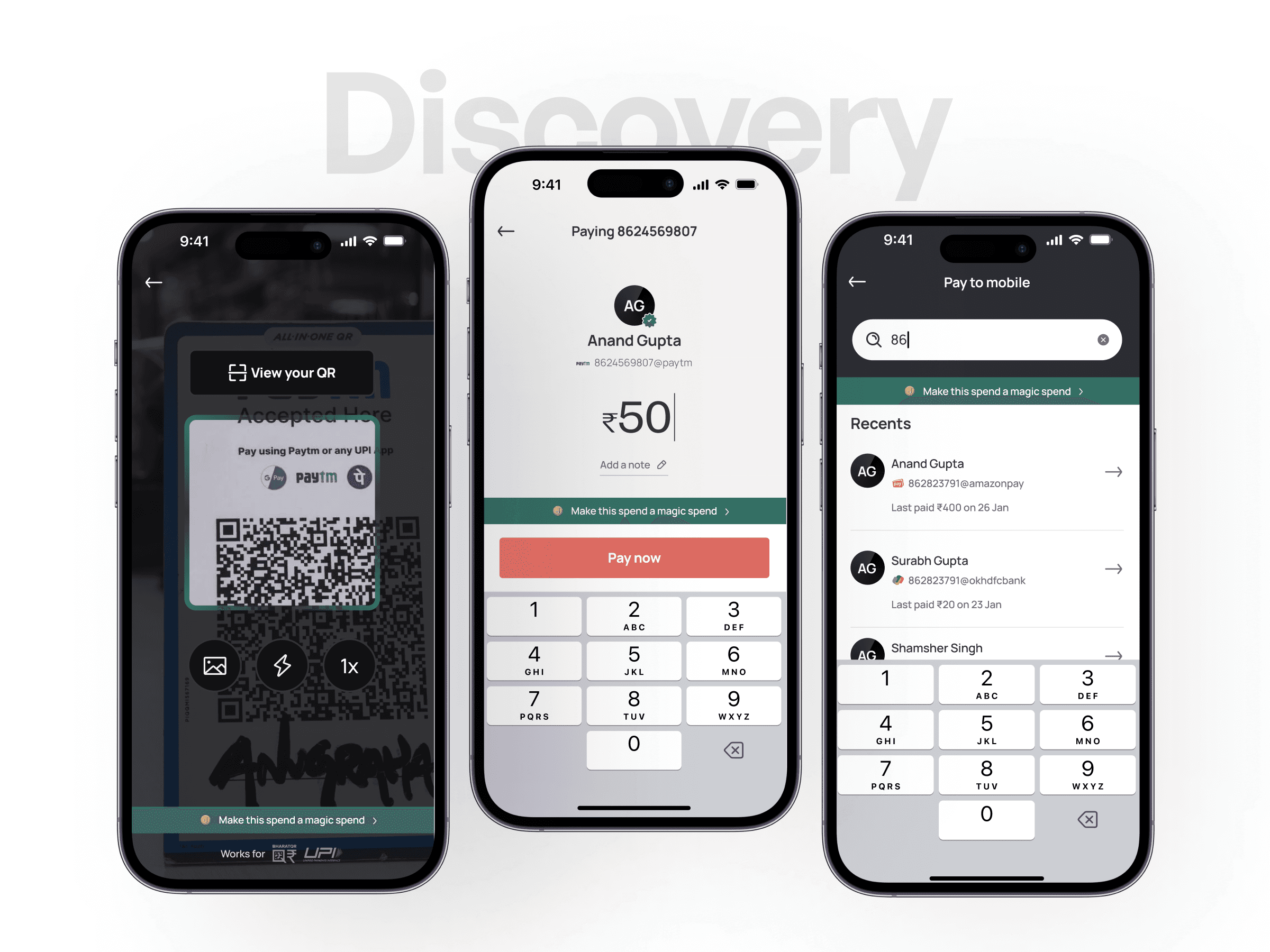

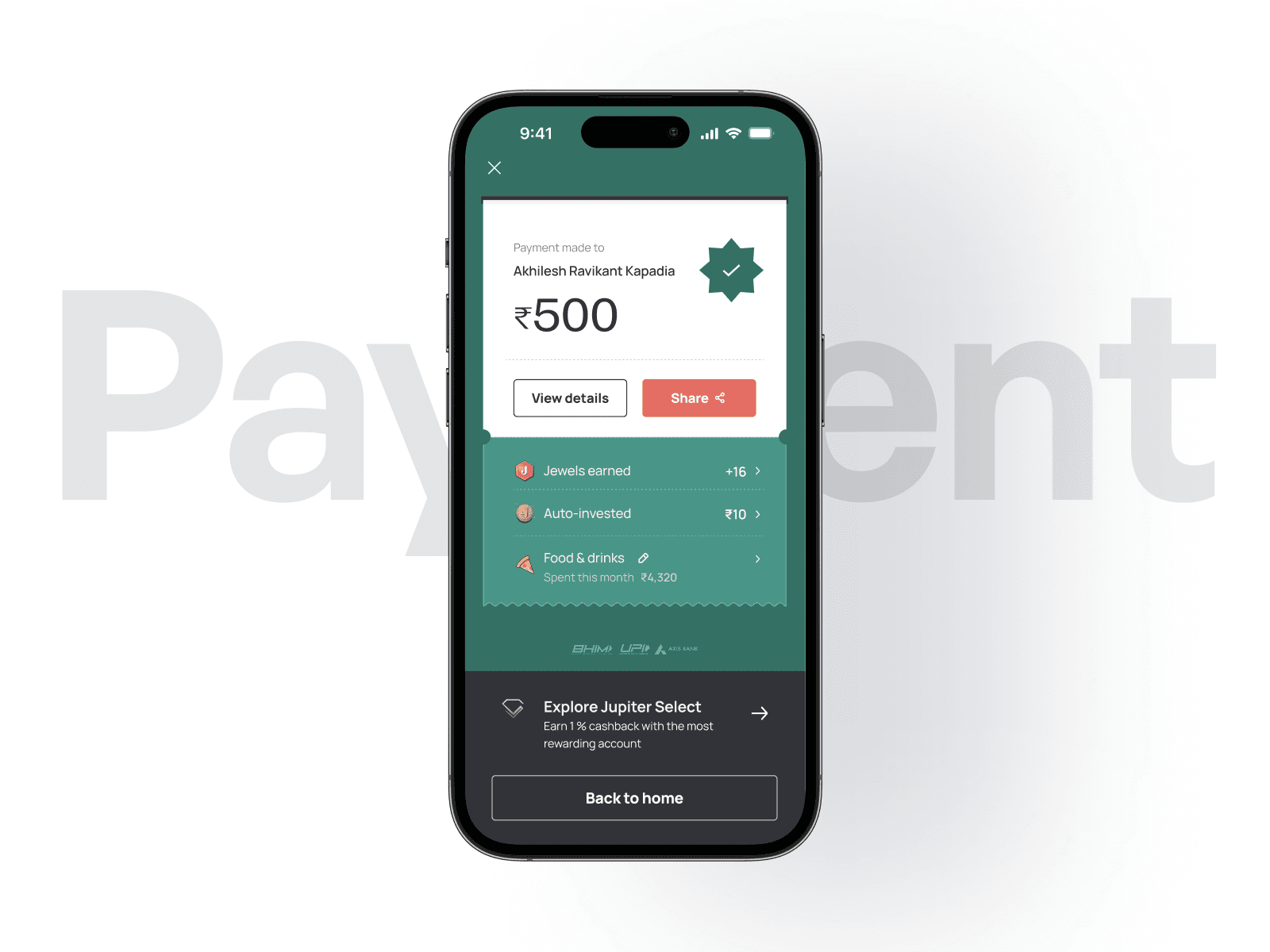

Revolutionising payments Introducing an industry first feature of 'Magic Spends'

Revolutionising payments Introducing an industry first feature of 'Magic Spends'

Problem: Young Indians struggle to build consistent investing habits. Spending is instant and effortless, while saving requires intent, discipline, and manual action. As a result, impulsive purchases take priority, and regular investing becomes irregular or nonexistent.

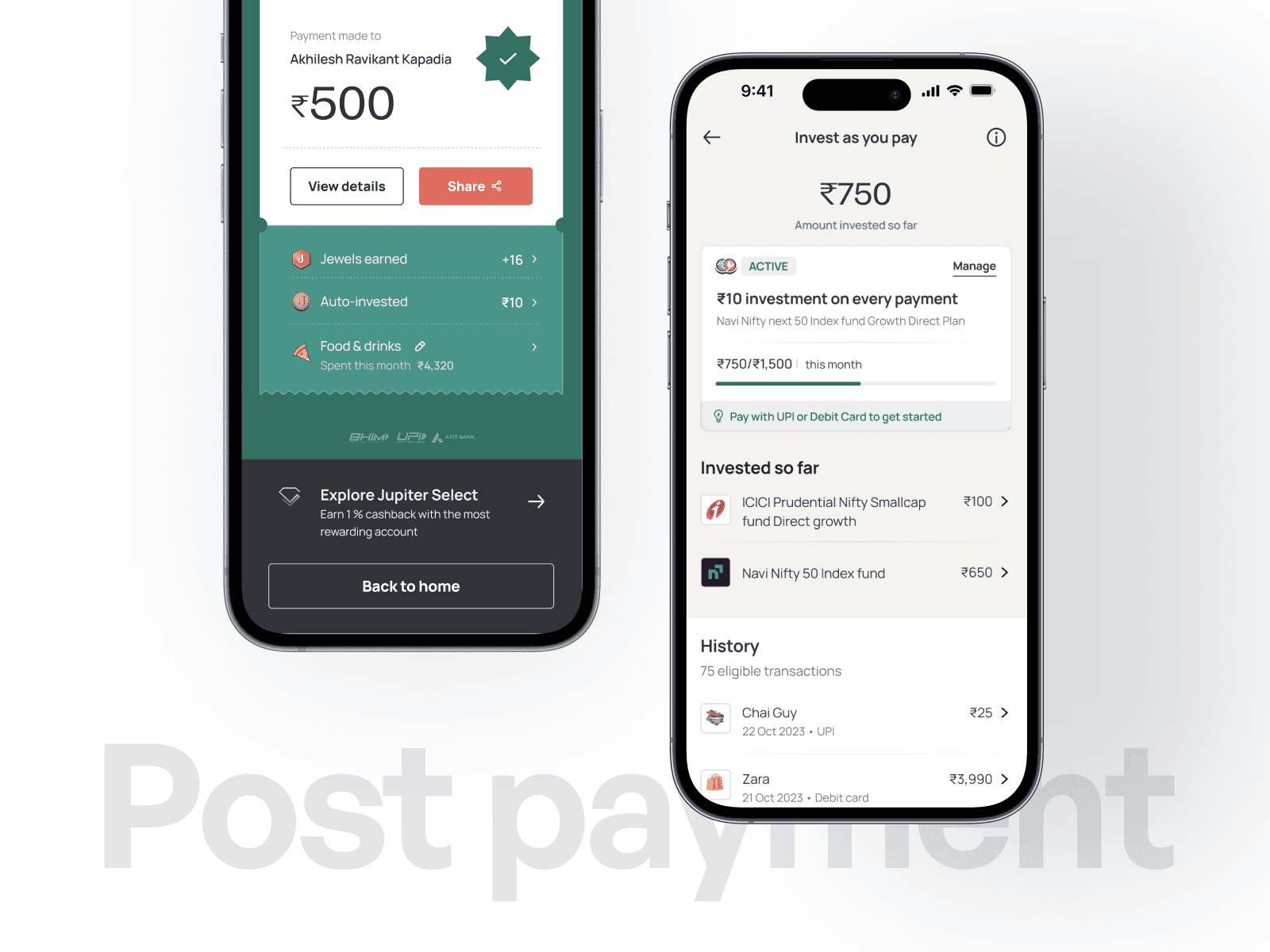

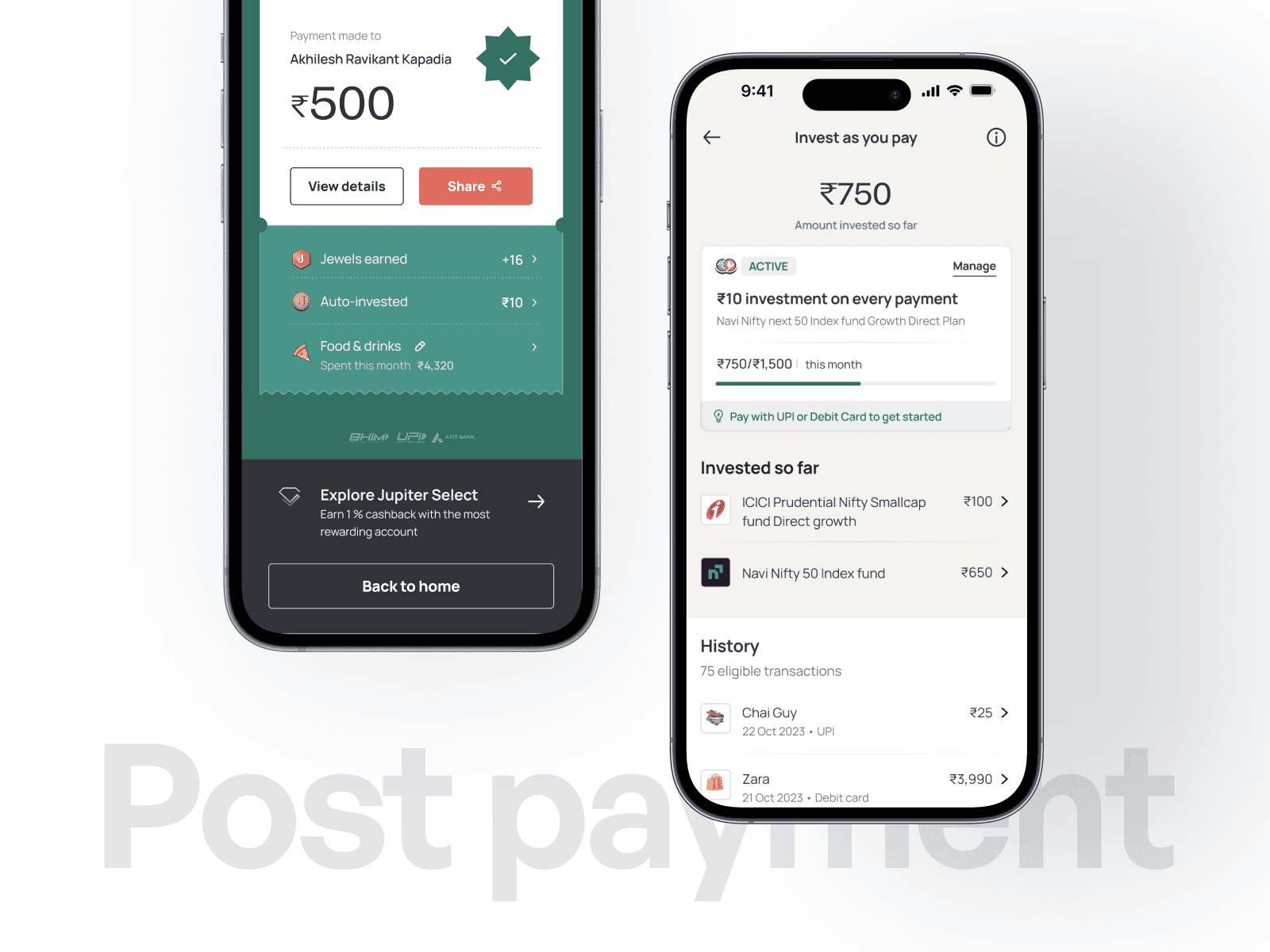

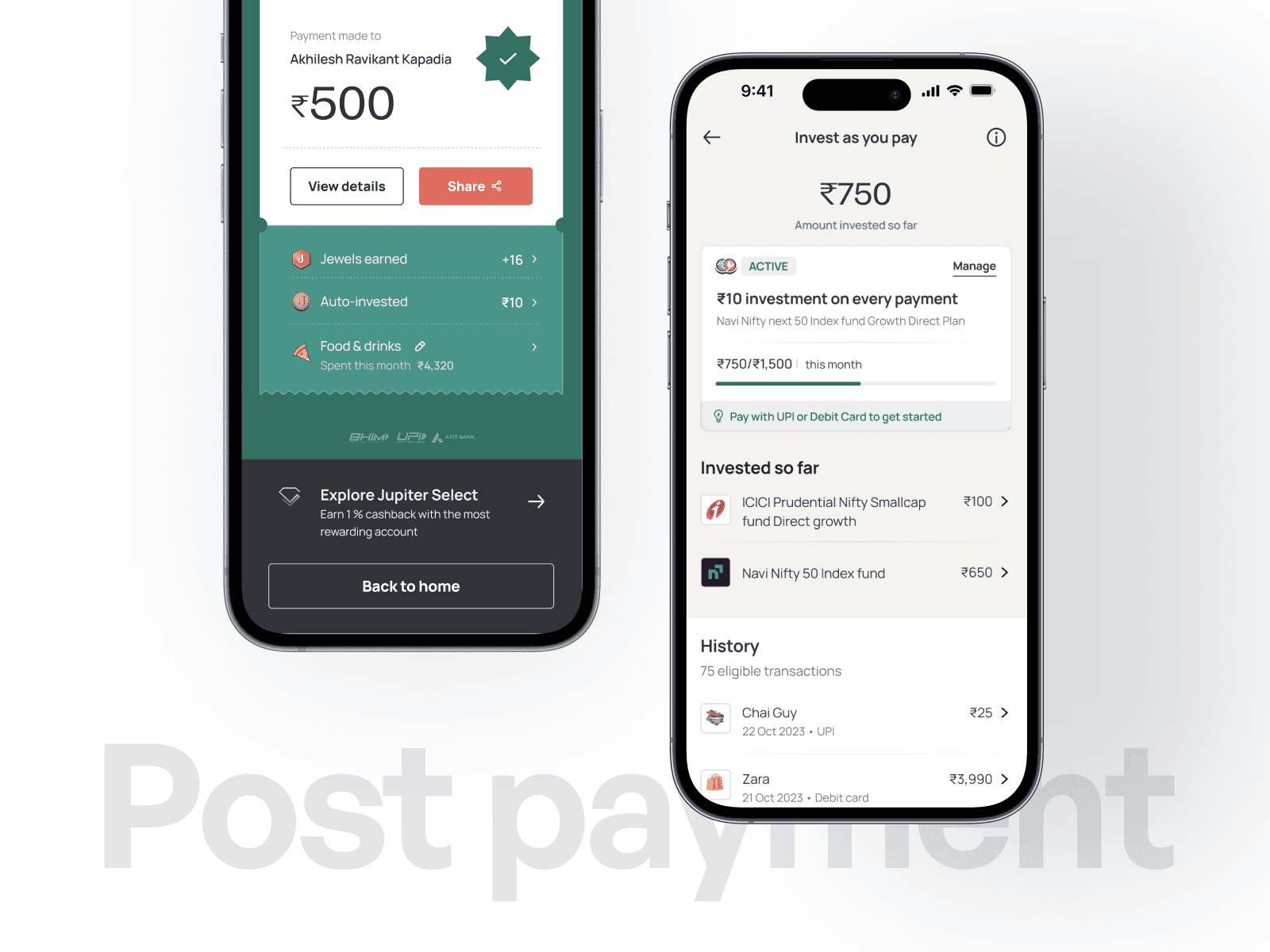

Solution: Magic Spends turns this behaviour on its head by auto-investing a small amount every time a user makes a UPI payment. By linking everyday spending with routine micro-investments, the feature makes wealth creation effortless, automated, and built directly into the payment flow.

Year

2024

Company

Jupiter

Role

Product designer 2

Year

2024

Company

Jupiter

35%

35%

Users invest more with Magic Spends on

27%

27%

higher engagement when Magic Spends was active

30%

30%

growth in Jupiter account transactions due to Magic Spends

My Role

Problem

I collaborated closely with the Investments team to shape the product proposition and ensure clarity around returns, fund selection, and micro-investment behaviour. On the Payments side, I was the sole owner of the end-to-end flows from identifying friction to redesigning the success screen and integrating Invest As You Pay seamlessly into the UPI journey.

Young digital consumers in India are comfortable spending but hesitate when it comes to investing—not due to knowledge gaps, but because there’s no effortless bridge connecting the two behaviours. Traditional products put users on the spot with the question, “How much do you want to invest?”

We flipped the script by asking 'What if investing didn’t feel like a choice at all?'

Research & Insights

Young digital consumers in India are comfortable spending but hesitate when it comes to investing—not due to knowledge gaps, but because there’s no effortless bridge connecting the two behaviours. Traditional products put users on the spot with the question, “How much do you want to invest?”

We flipped the script by asking 'What if investing didn’t feel like a choice at all?'

From 225 surveyed users and 12 in-depth interviews, the signal was even stronger:

79% wanted investing “without thinking.”

61% preferred automated systems connected to everyday actions like tapping, swiping, or scanning.

72% said, “I spend without realising this would help me reverse that.”

Solution

What if every payment helped users get richer

This wasn’t just a feature idea. It was a new mental model:

Spending becomes investing.

Guilt becomes progress.

Consumption becomes contribution.

This one-line insight became our north star and the foundation of Magic spends

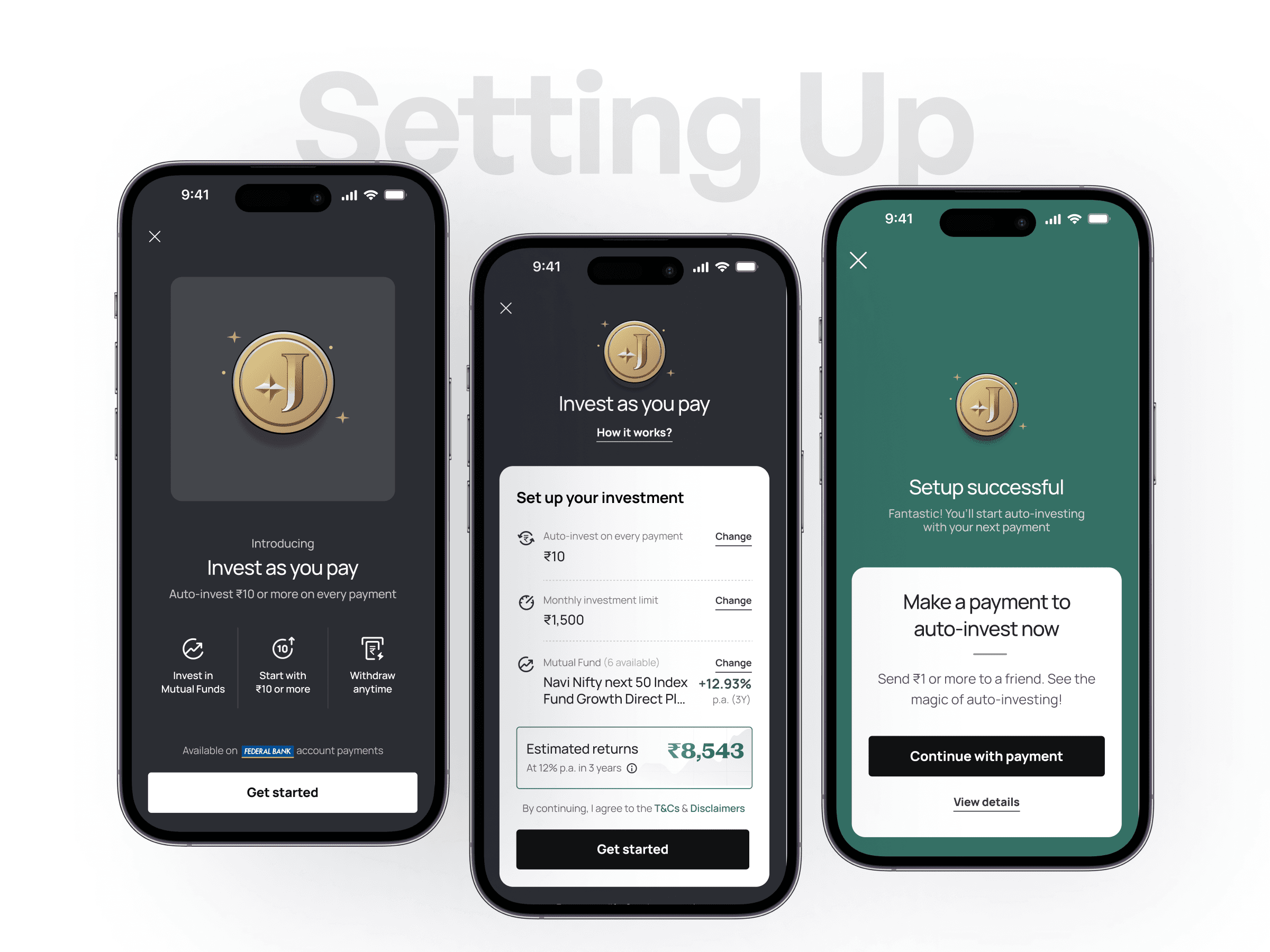

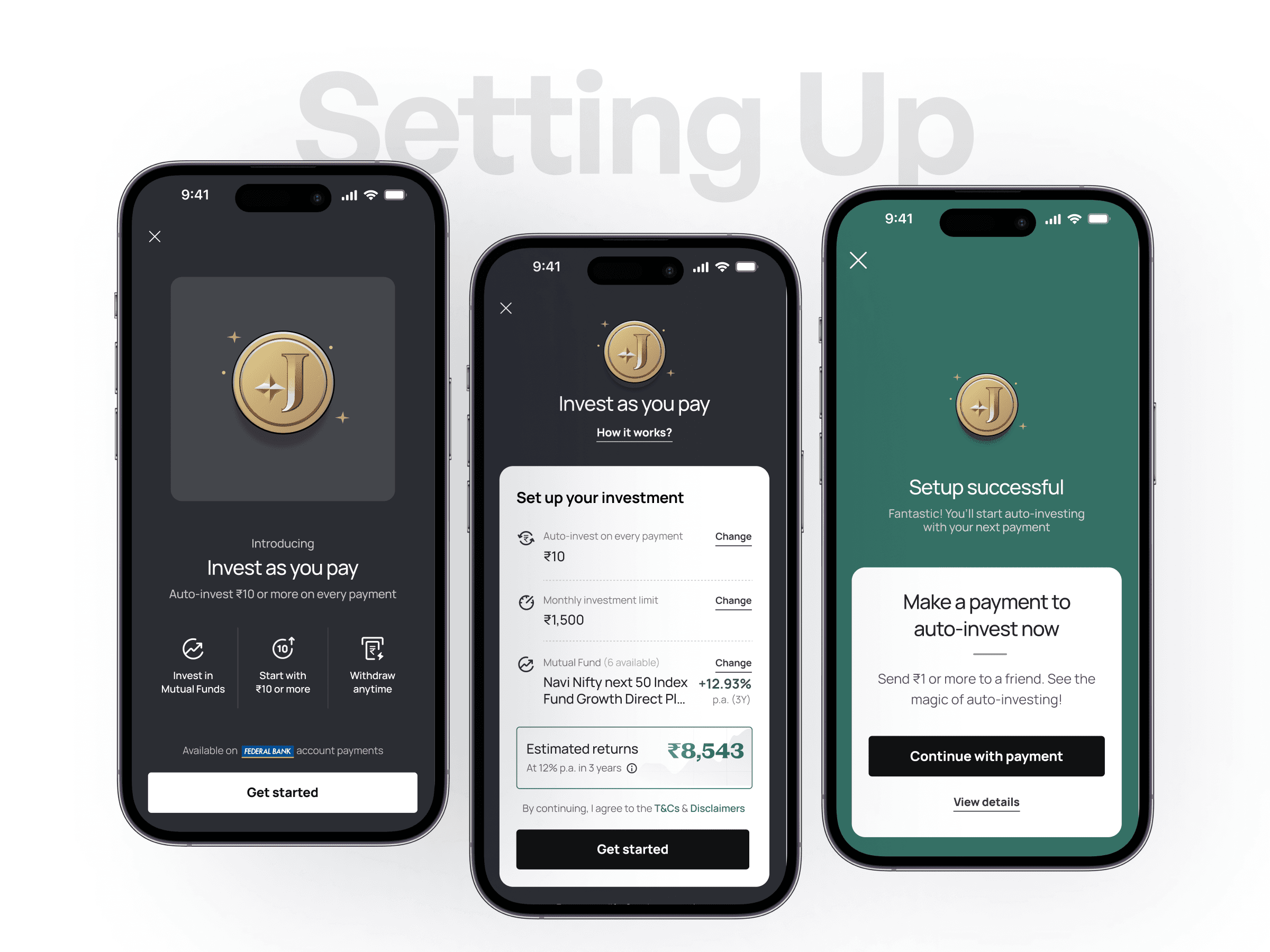

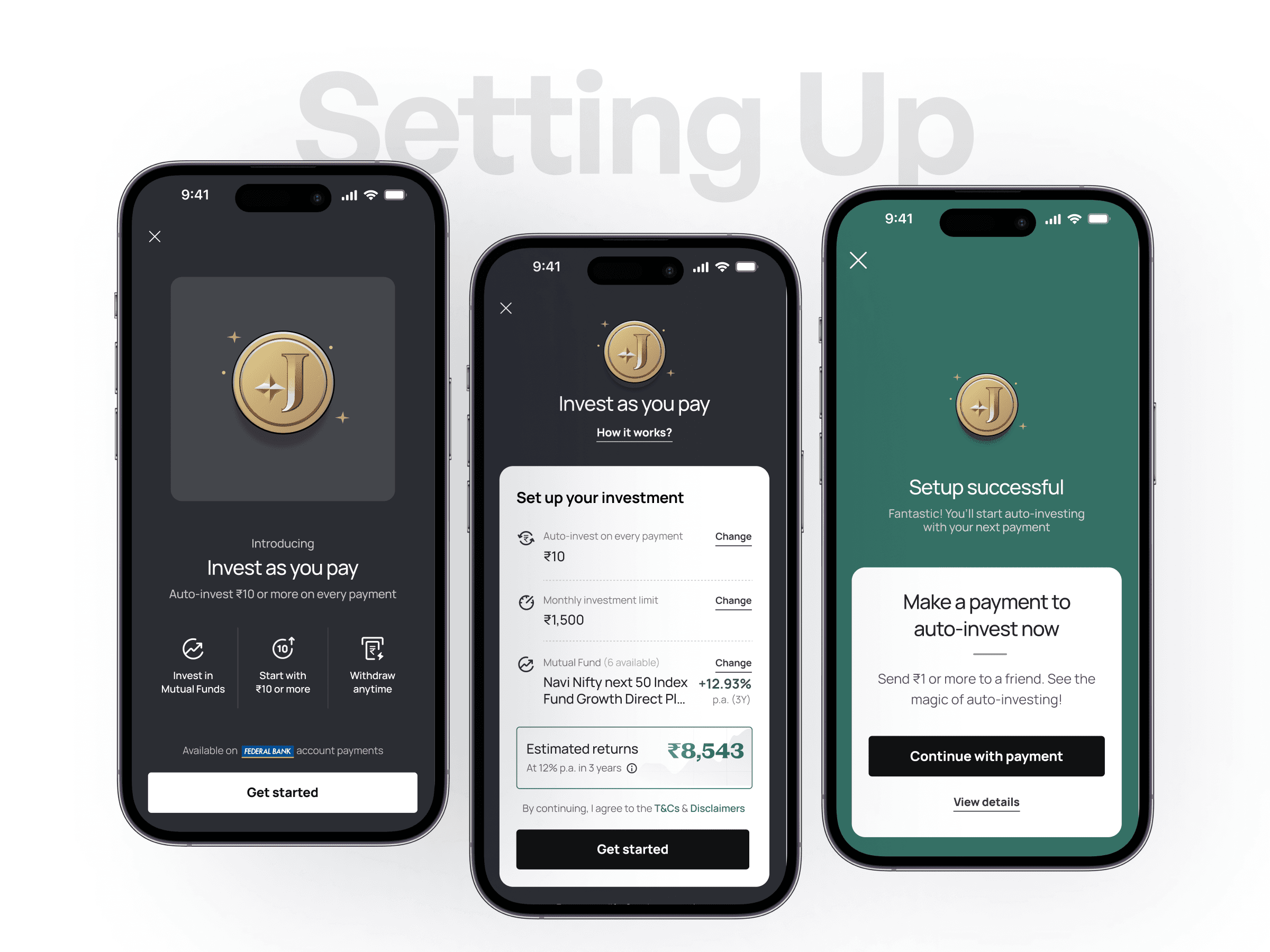

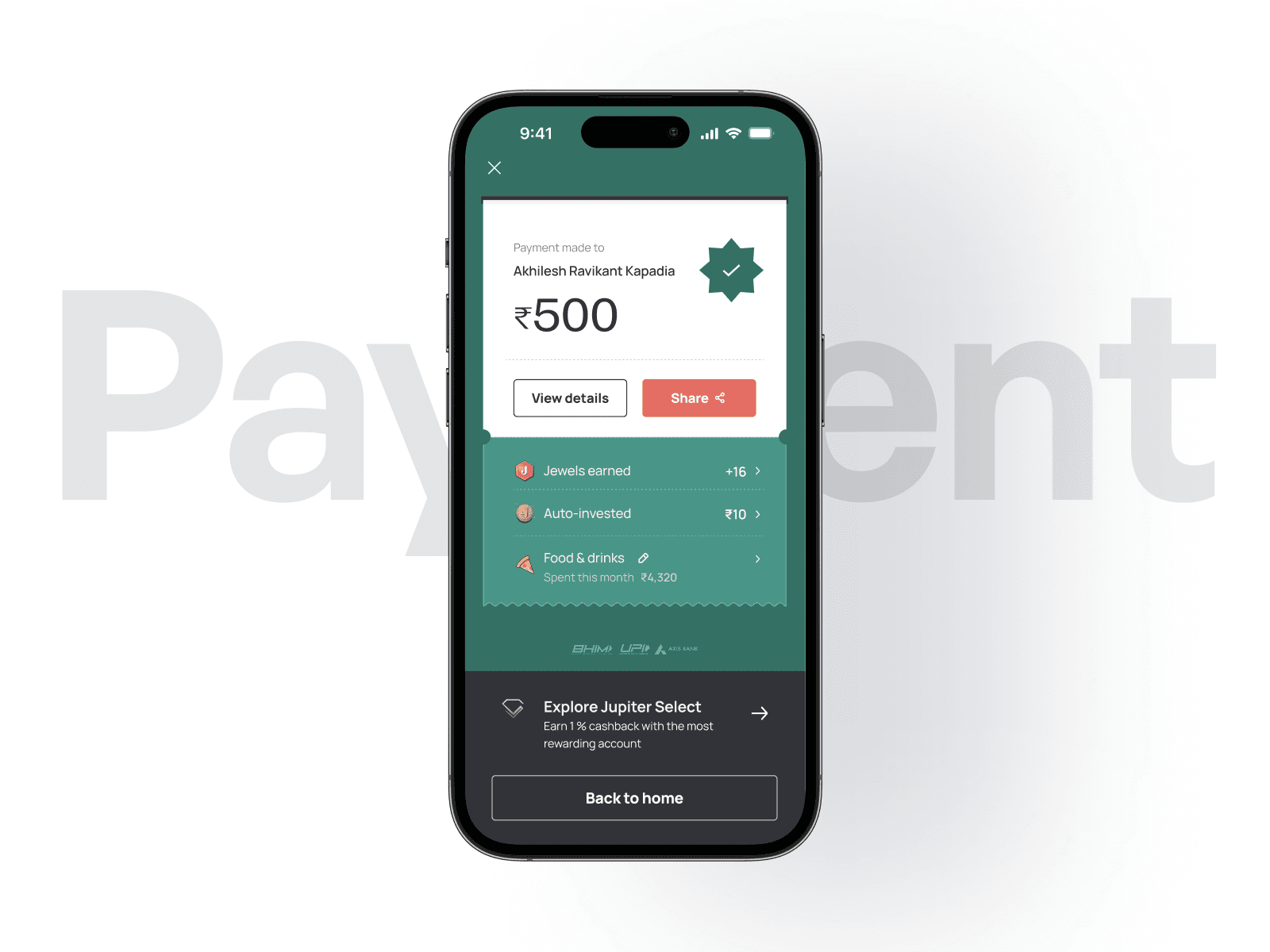

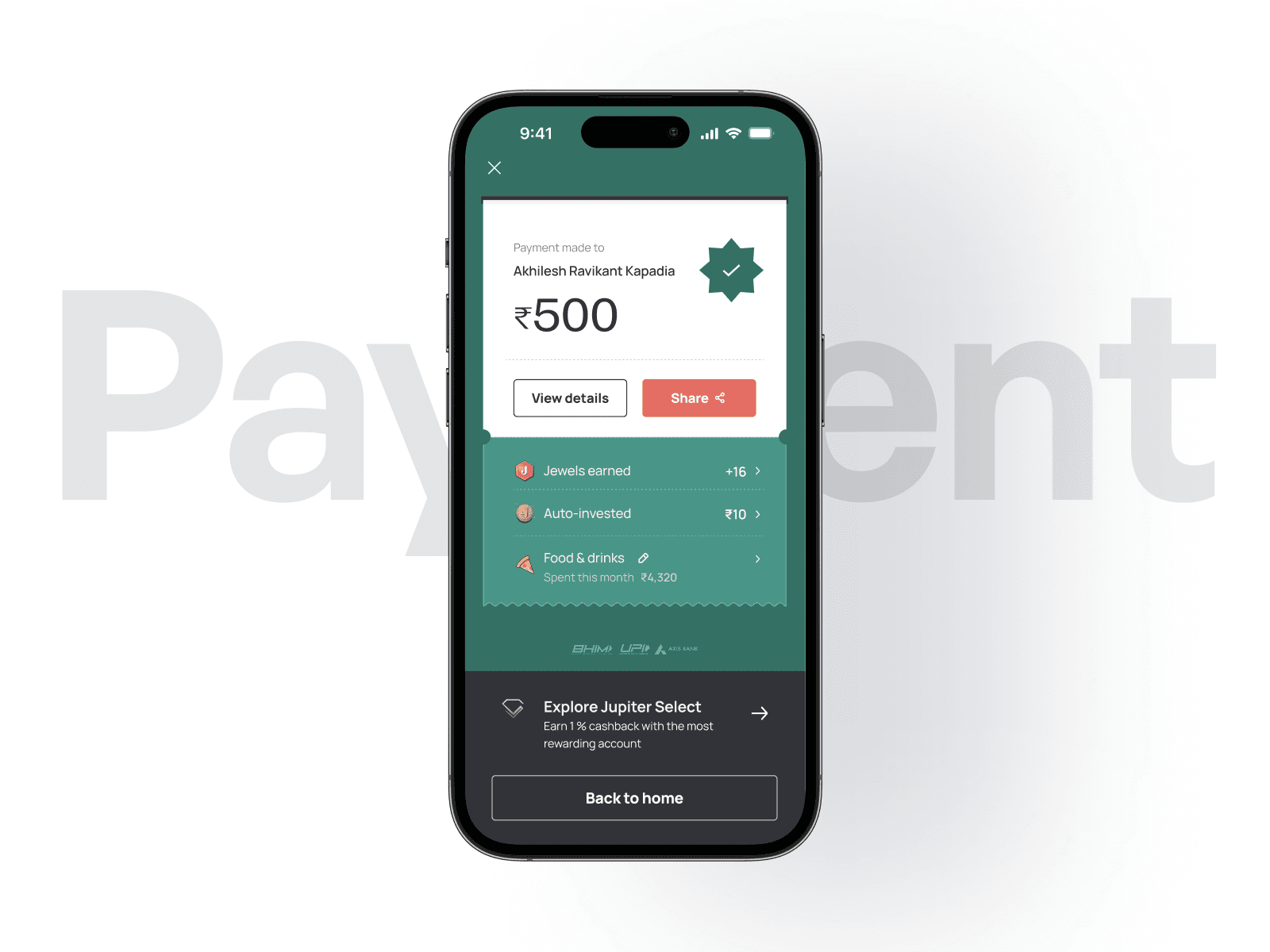

We designed a lightweight feature that lets users auto-invest more than ₹10 every time they make a payment through UPI or debit card. Spend ₹199 on Swiggy → ₹20 is auto-invested in mutual funds or digital gold. It’s customisable, invisible, and beautifully reassuring.

Core Principles:

✅ No friction: 30-second opt-in.

✅ No anxiety: Small, recurring amounts. No pressure.

✅ No silence: Delightful nudges, weekly summaries, and visual feedback that shows progress.

We designed not just a tool, but a habit loop built on behaviour design based on BJ Fogg's behaviour model, not dashboards.

My Role

I collaborated closely with the Investments team to shape the product proposition and ensure clarity around returns, fund selection, and micro-investment behaviour. On the Payments side, I was the sole owner of the end-to-end flows from identifying friction to redesigning the success screen and integrating Invest As You Pay seamlessly into the UPI journey.

Problem

Problem

Young digital consumers in India are comfortable spending but hesitate when it comes to investing—not due to knowledge gaps, but because there’s no effortless bridge connecting the two behaviours. Traditional products put users on the spot with the question, “How much do you want to invest?”

We flipped the script by asking 'What if investing didn’t feel like a choice at all?'

Research & Insights

From 225 surveyed users and 12 in-depth interviews, the signal was even stronger:

79% wanted investing “without thinking.”

61% preferred automated systems connected to everyday actions like tapping, swiping, or scanning.

72% said, “I spend without realising this would help me reverse that.”

Solution

We designed a lightweight feature that lets users auto-invest more than ₹10 every time they make a payment through UPI or debit card. Spend ₹199 on Swiggy → ₹20 is auto-invested in mutual funds or digital gold. It’s customisable, invisible, and beautifully reassuring.

Core Principles:

✅ No friction: 30-second opt-in.

✅ No anxiety: Small, recurring amounts. No pressure.

✅ No silence: Delightful nudges, weekly summaries, and visual feedback that shows progress.

We designed not just a tool, but a habit loop built on behaviour design based on BJ Fogg's behaviour model, not dashboards.

Impact

35%

Users invest more with Magic Spends on

27%

higher engagement when Magic Spends was active

30%

growth in Jupiter account transactions due to Magic Spends

35%

Users invest more with Magic Spends on

35%

Users invest more with Magic Spends on

27%

higher engagement when Magic Spends was active

30%

growth in Jupiter account transactions due to Magic Spends

Impact

35%

Users invest more with Magic Spends on

27%

higher engagement when Magic Spends was active

30%

growth in Jupiter account transactions due to Magic Spends

Impact

35%

Users invest more with Magic Spends on

27%

higher engagement when Magic Spends was active

30%

growth in Jupiter account transactions due to Magic Spends